Charts This Week #2

Charts and links about China

We paused billing on RCC last week while we reorient the publication. A special thanks to all those who reached out to us to share their support for what we are doing.

Charts This Week #2

New homes sales of top 100 developers

A new lower low. Chart from WSJ1

Local government debt continue to rise, ditto with interest payments

Growth in debt outpacing GDP (btw, should compare with nominal GDP as debt is nominal). Charts from Caixin2

Funding for real estate developers ended 2023 down 13.6%

Express mail volumes remain a bright spot

Well above the pre-pandemic 3-year trend. Very curious what the Gross Values are, whether total values are up with volumes or if only volumes are up (more small packages being delivered).

December cement output was the lowest since Dec-2009

Other down spikes are Spring Festival related.

Confidence & home price increases

Number of cities with YoY home price increases were 20 and 2 cities for new homes and 2nd hand, respectively. Does real estate need to recover for the stock market to turn?

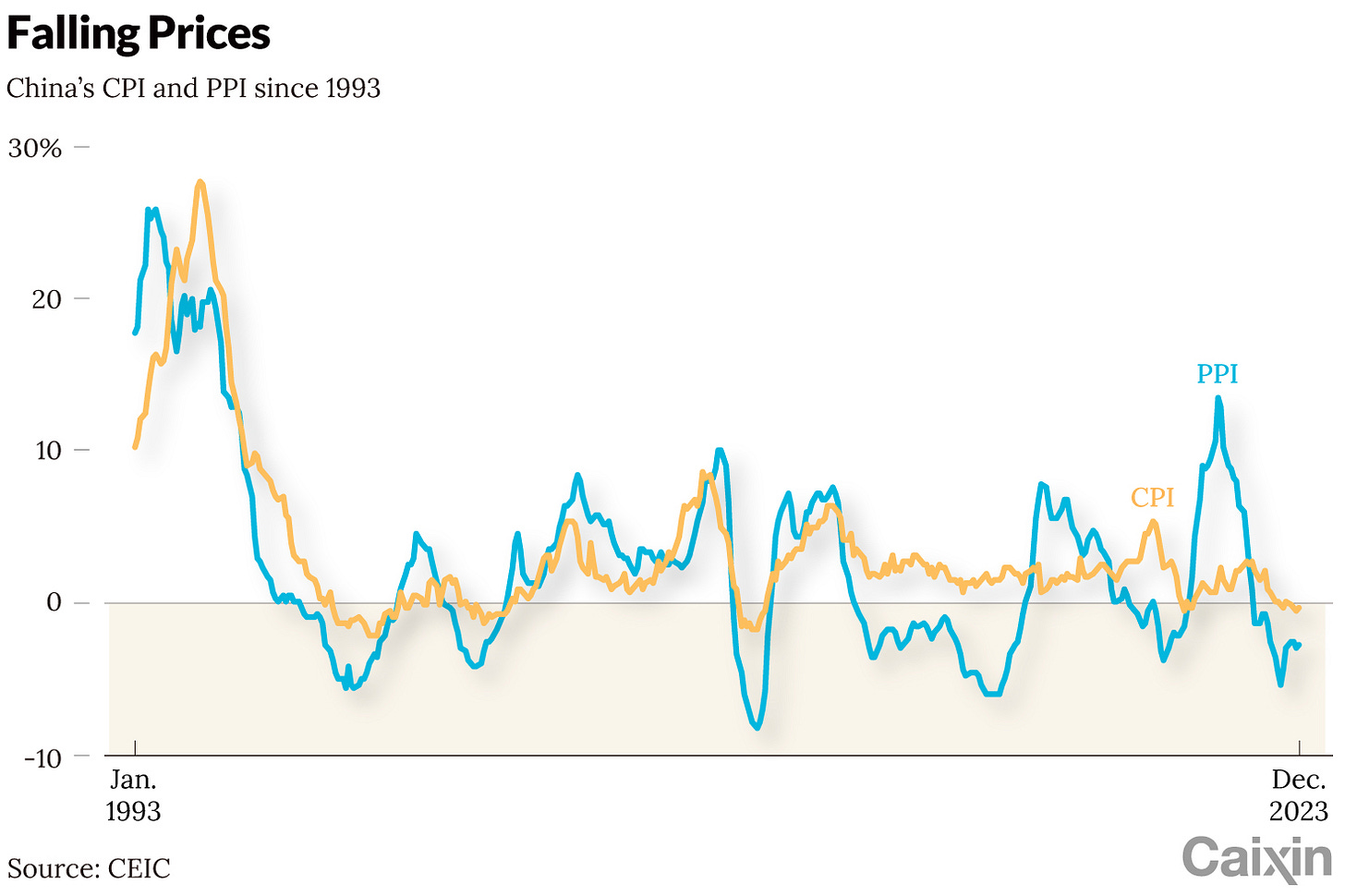

Deflation

Caixin has a good piece on deflation and what can be tried about it.

Rhodium Group on China’s GDP and economy

Great analysis and charts, as usual.

The realities of a still-shrinking property sector, limited consumer spending, falling trade surplus, and battered local government finances mean that actual growth in 2023 was more like 1.5%.

We’ll share some charts here, but go read the full piece if you haven’t already.

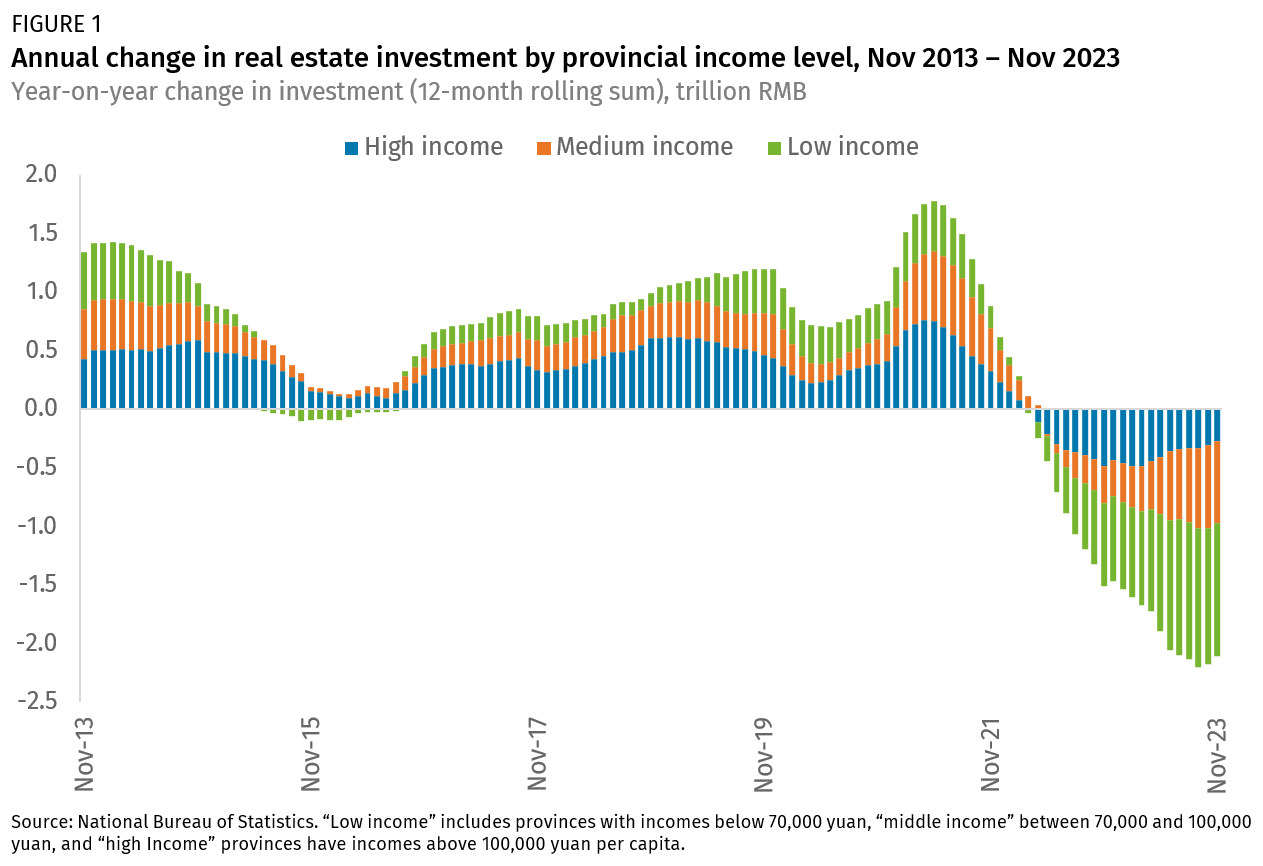

Real estate investment

This chart shows the annual change in real estate investment (yoy, trailing 12 month). What’s notable is the high income provinces (blue) bottomed Feb/March of 2023, but medium income provinces continuously got worse and low income provinces may have just bottomed—we’ll see.

Government spending

2023 started with a modest rise in the targeted fiscal deficit, from 2.8% of GDP in 2022 to 3.0%. But falling property activity decimated local government revenues as land sales fell sharply.

If local funds are included in government spending, the year-on-year change has been negative all year.

Consumption

In January 2023, many analysts argued that Chinese consumers had built up savings and were ready to spend.

Not yours truly, by the way, see out pinned post: What’s behind high household net deposits.

In reality, the rise in household deposits did not reflect significant growth in actual savings, but rather households shifting away from risky wealth management products to safer but locked-in time deposit accounts, with most of these transactions occurring among a small share of high-income households. The bulk of Chinese earners faced slowing income growth from zero-COVID disruptions, the property crunch, a crackdown on high-growth technology employers, and weakening export manufacturing activity.

Yes. Many in China would like to get out of this slump and put recent experiences behind them.

Rather than increasing consumption, Chinese households were deleveraging in 2023. At the end of the third quarter, outstanding credit card loans contracted by RMB 130 billion compared to a year ago, and mortgage loans had declined by RMB 600 billion. The national decline in property values continues to weigh on household confidence.

This is the money chart in the piece, in our opinion.

"There are two kinds of disequilibrium: static disequilibrium, where both the prevailing dogma and the prevailing social conditions are rigidly fixed but quite far removed from each other; and dynamic disequilibrium, where both the real world and the participant’s views are changing so rapidly that they cannot help but be far apart." - George Soros

Question for you, dear reader: is China in disequilibrium in some way? If so, is it static or dynamic? Why or why not?

That’s all. We’ll be back after the Spring Festival break. Happy Chinese Near Year to you!

I read the Rhodium report (thanks for the link), but could not see how they arrived at the view that GDP growth was 1.5% for 2023. I understand IMF estimate for China’s GDP is in line with China’s government. So should we prefer Rhodium’s estimate to the IMF-cum-official estimate?

Perhaps I missed the explanation, but if you understood the explanation for Rhodium’s estimate, perhaps you can explain in a future post?

Rhodium Group on China’s GDP and economy Great analysis?

Rhodium is yet another bs Western 'analyst'. Usually more wrong than right – and skewed towards Western interpretations of events.

The only reliable Chinese predictions and stats comes from the relevant ministries in Beijing. The rest is Mastercard.

Check Beijing's prediction/outcome record against any other on the Planet. It's not even close.

I live two hours from the Chinese border and visit regularly to verify their claims. Not only have I never found discrepancy between prediction and progress, but they often make progress further than predicted. And the people really are the happiest on earth.

96% of them think their country's headed in the right direction. Ninety-six fucking percent!

Hence 'predictions' like these:

1990. China's economy has come to a halt. The Economist

1996. China's economy will face a hard landing. The Economist

1998. China's economy’s dangerous period of sluggish growth. The Economist

1999. Likelihood of a hard landing for the Chinese economy. Bank of Canada

2000. China currency move nails hard landing risk coffin. Chicago Tribune

2001. A hard landing in China. Wilbanks, Smith & Thomas

2002. China Seeks a Soft Economic Landing. Westchester University

2003. Banking crisis imperils China. New York Times

2004. The great fall of China? The Economist

2005. The Risk of a Hard Landing in China. Nouriel Roubini

2006. Can China Achieve a Soft Landing? International Economy

2007. Can China avoid a hard landing? TIME

2008. Hard Landing In China? Forbes

2009. China's hard landing. China must find a way to recover. Fortune

2010: Hard landing coming in China. Nouriel Roubini

2011: Chinese Hard Landing Closer Than You Think. Business Insider

2012: Economic News from China: Hard Landing. American Interest

2013: A Hard Landing In China. Zero Hedge

2014. A hard landing in China. CNBC

2015. Congratulations, You Got Yourself A Chinese Hard Landing. Forbes

2016. Hard landing looms for China. The Economist

2017. Is China's Economy Going To Crash? National Interest

2018. China's Coming Financial Meltdown. The Daily Reckoning.

2019 China's Economic Slowdown: How worried should we be? BBC2020. Coronavirus Could End China's Decades-Long Economic Growth Streak. NY Times

2021 Chinese economy risks deeper slowdown than markets realize. Bloomberg

2022. China Surprise Data Could Spell R-e-c-e-s-s-i-o-n. Bloomberg.

2023. No word should be off-limits to describe China's faltering economy. Bloomberg