The Future of American Manufacturing Is Already Here—Can You See It?

The new jobs, new tools, and new energy of U.S. manufacturing - Industrial Policy #8

Few people have the imagination for reality.

—Goethe

What does Goethe mean here? To me, it’s a recognition that beliefs—often formed in a world that no longer exists—can blind us to what’s happening right in front of us. We assume we’re seeing reality clearly, but more often we’re filtering it through outdated models and assumptions.

To see the present clearly, imagination is essential. That sounds counterintuitive. But the world doesn’t always announce when it changes. Reality shifts slowly, then all at once. If you’re not actively updating your mental map, you’ll miss it.

It’s like the parable of the blind men and the elephant: each touches a different part and jumps to a conclusion ("It’s a tree!" "It’s a snake!") without grasping the whole. They weren’t lacking data. They were lacking imagination.

William Gibson put it this way: “The future is already here—it’s just unevenly distributed.” That’s not just about sci-fi and tech startups. It applies to every domain where new realities are quietly taking hold before the rest of the world catches up.

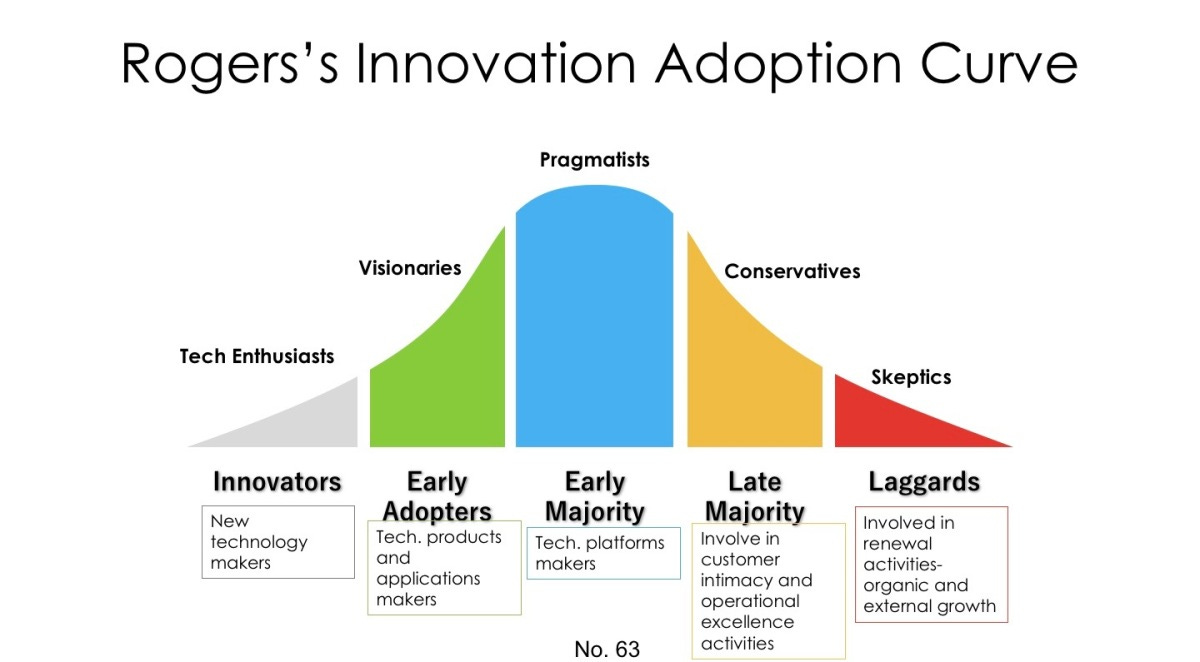

The adoption curve of innovation is a helpful visual here. Most people don’t engage with new realities until they’re in the majority. But some live in the future early because they can see it or can build it. They're not delusional. They're imaginative about reality.

Which brings us to American manufacturing—and to people like Chris Power.

Thank you for subscribing. Occasional forwarding is okay. If you are not a member, please sign up here.

Meet Someone Living in the Future

Chris Power, founder and CEO of Hadrian, isn’t predicting the future of manufacturing—he’s already building it. And what he’s building should feel shocking. Not because it’s sci-fi, but because it already exists, and most people still think it's impossible.

Here’s the punchline: Hadrian can manufacture in the U.S. at only a ~30% premium to China—today. That number is falling. Soon, they expect to reach parity. That’s not theory. That’s happening.

“In some cutting-edge sectors, U.S. factories like Hadrian are only about 30% more expensive than China now — a major technological leap forward, and we could reach parity or better soon.”

They’re achieving this by reimagining what factory work looks like. Forget the smokestacks and deafening shop floors of the past. This is something else entirely.

“Factories like SpaceX, Hadrian, Anduril — those are awesome jobs… The mindset just has to shift.”

Hadrian uses automation and technology to give their workers “Iron Man suits”—not literally, but close. With robotics, software, and high-leverage systems, one person can now run ten machines. The goal isn’t to eliminate workers—it’s to multiply their impact.

“Unless we give the American workforce an ‘Iron Man suit’... we don’t have the skilled labor to reindustrialize.”

This is the missing piece in most discussions about reshoring: productivity. In an age where labor is scarce, especially for defense-linked manufacturing, you can’t just bring back old jobs. You have to build new ones—faster to train, easier to scale, more rewarding to do.

“These jobs can pay well. They can offer great insurance. At Hadrian, we give everyone equity in the company.”

And if you think the cost gap with China is just about wages, think again. Power makes the case that China’s cost advantage is artificially inflated by massive subsidies—on materials, energy, capital, and exports.

“Because China operates with looser environmental regulations and offers energy subsidies, the cost of raw materials there can be 10 to 20 times cheaper than in the U.S.”

“Chinese exporters get export rebates — they might get 30% to 40% of the sale price back when selling to an American buyer… It’s a policy to de-industrialize the U.S.”

So the story isn’t just about labor or capitalism or even trade. It’s about who’s playing the game, and how. Hadrian isn’t winning because the rules changed—they’re winning by playing differently.

“Everyone has been trained to think that manufacturing isn’t a growth industry. That you can’t put a billion dollars of capex to work and expect it to pay off over ten years. And that’s what makes Hadrian different.”

The bigger picture Power paints is this: America’s industrial base didn’t just erode—it bifurcated. The defense side stayed (regulated by ITAR), while the commercial side fled offshore. That split killed scale, energy, investment—and morale.

“If you’re an engine manufacturer, your only growth comes from defense — and defense doesn’t offer long-term visibility. Very hard to justify a billion-dollar investment in an advanced factory on that basis.”

But Power is making the long-term bet. And he’s doing it by treating manufacturing like tech: high-capex, growth-oriented, driven by systems and automation.

“We punished capex like it was a sin. It’s the opposite of how you’d treat a tech company.”

This is why we need imagination. Not for some distant future… but to see what's already here.

Watch the whole discussion Oren Cass had with Chris Power on YouTube:

If you read this far, thank you! We clearly have a shared interest. Please consider subscribing to a paid tier to support my work. Also consider hitting the like button, it helps others discover us. Comments are only open to premium members, but feel free to DM me with any thoughts.

Read more of my posts on Industrial Policy/Commons

I learned a ton from this episode. Go listen on YouTube, Overcast, Spotify, or Apple! Below I share a transcript with light-to-medium edits for those that want to dig deeper here.