Charts This Week 10

Loan demand down, rise in first time criminal convictions, Wind power industry, US-China trade deterioration, Podcast rec and comment

*This is a premium members post. A free preview of about 50% is provided. Thank you for your support!

“You can lead a horse to water, but you can’t make it drink.”

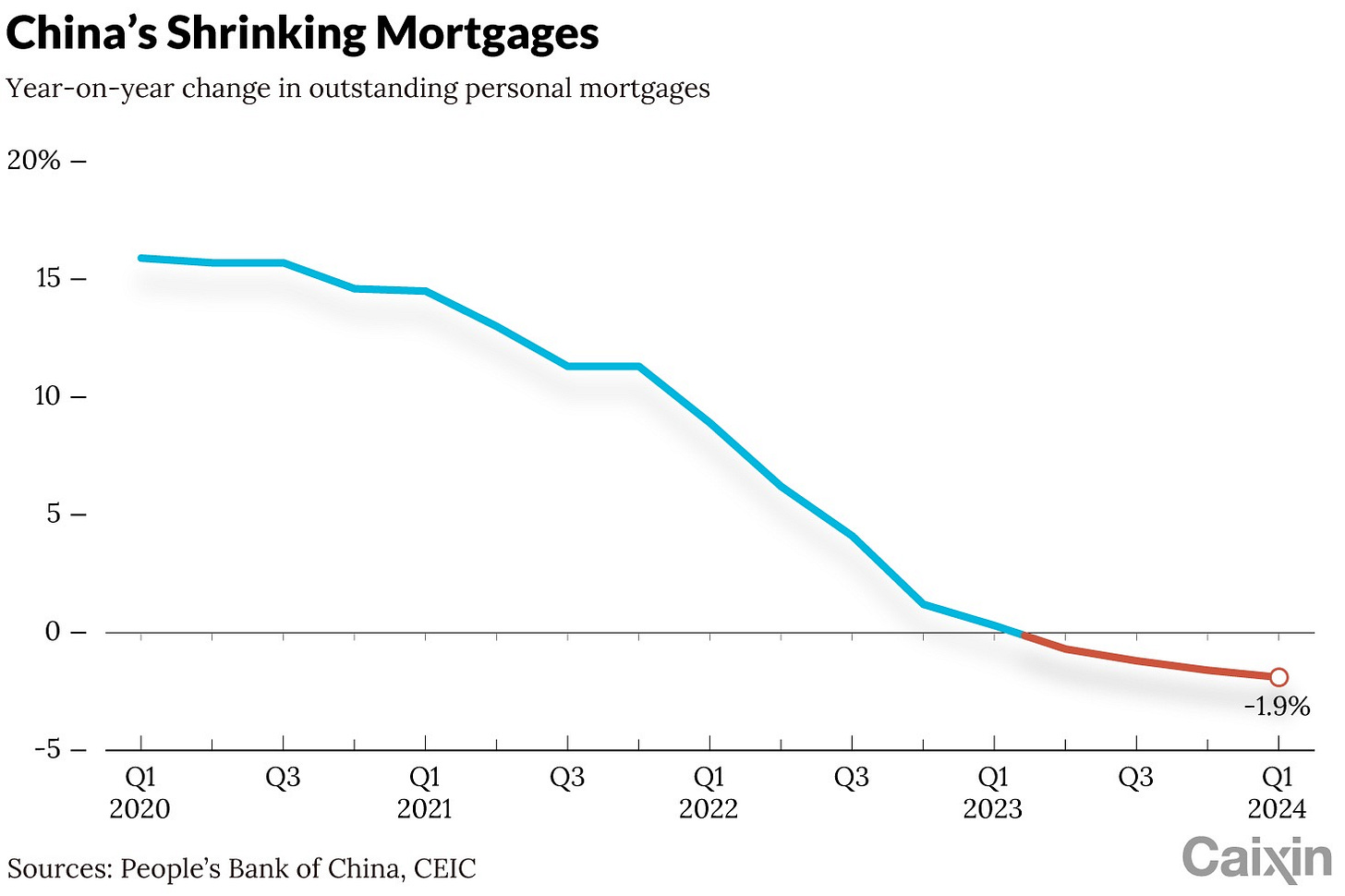

Demand for mortgages declines

As of Q1’2024, personal mortgages were declining year-on-year.

This is serious enough to spur regulators to remove the mortgage rate floor for individual home buyers and lower the required down-payment percentages for first and second homes.

The People’s Bank of China (PBOC) effectively scrapped the nationwide minimum mortgage interest rate while cutting the minimum down-payment ratio to 15% for first-time buyers and 25% for second homes, according to a statement on Friday. The previous ratios stood at 20% and 30%, respectively.1

But that’s not all. Some desperate developers are offering to pay the down payment for buyers. Yikes.

Disguised zero down payments, which are officially banned in China, have become a growing trend in some cities as developers of new homes and owners of pre-owned homes are desperate to sell in a sluggish market. Experts warn that such practices will distort home price statistics and increase risk for mortgage lenders.

In the southern city of Huizhou, Guangdong province, the developer of a new housing project is attracting buyers with a range of incentives such as zero down payments, complimentary parking spaces and five years of free property management.2

Such practices lead to houses being sold at prices significantly lower than advertised, skewing statistics and affecting the judgment of policymakers as they assess the state of the property market.

Loan demand was weaker than appeared

Rhodium Group piece on New Industrial loans not going to manufacturing, instead going to rolling LGFV loans, rolling small firms pandemic loans, or companies parking cheap loans in time-deposits.

“The reality is that China’s domestic credit demand is extremely weak,” Rhodium analysts including Endeavour Tian wrote. “The financial system is highly inefficient, channeling new credit into financial arbitrage and local debt restructuring, rather than new manufacturing investment.”

But Rhodium found much of the increase in industrial loans were driven by banks’ refinancing to local government financing vehicles — companies that borrow on behalf of provinces and cities to fund infrastructure — as well as extended loan repayment for small firms during the pandemic. Many companies also took cheap bank loans and channeled them into long-term time deposits and investment products to gain a profit.

Nothing to invest in. Same story I've heard over and over: "if you don't invest in anything, you won't lose money." Call it risk-aversion, lack of demand, geopolitical uncertainty, fear of war. All of the above.

But in a sign of worries over inefficient loan use, the People’s Bank of China has in recent months vowed to look into “idling” money in the financial system that isn’t benefiting the real economy. The central bank is “closely monitoring” the practice of companies taking out loans to transfer them into deposits, and stepping up efforts to ensure funds are used more efficiently, Deputy Governor Xuan Changneng told reporters in March.

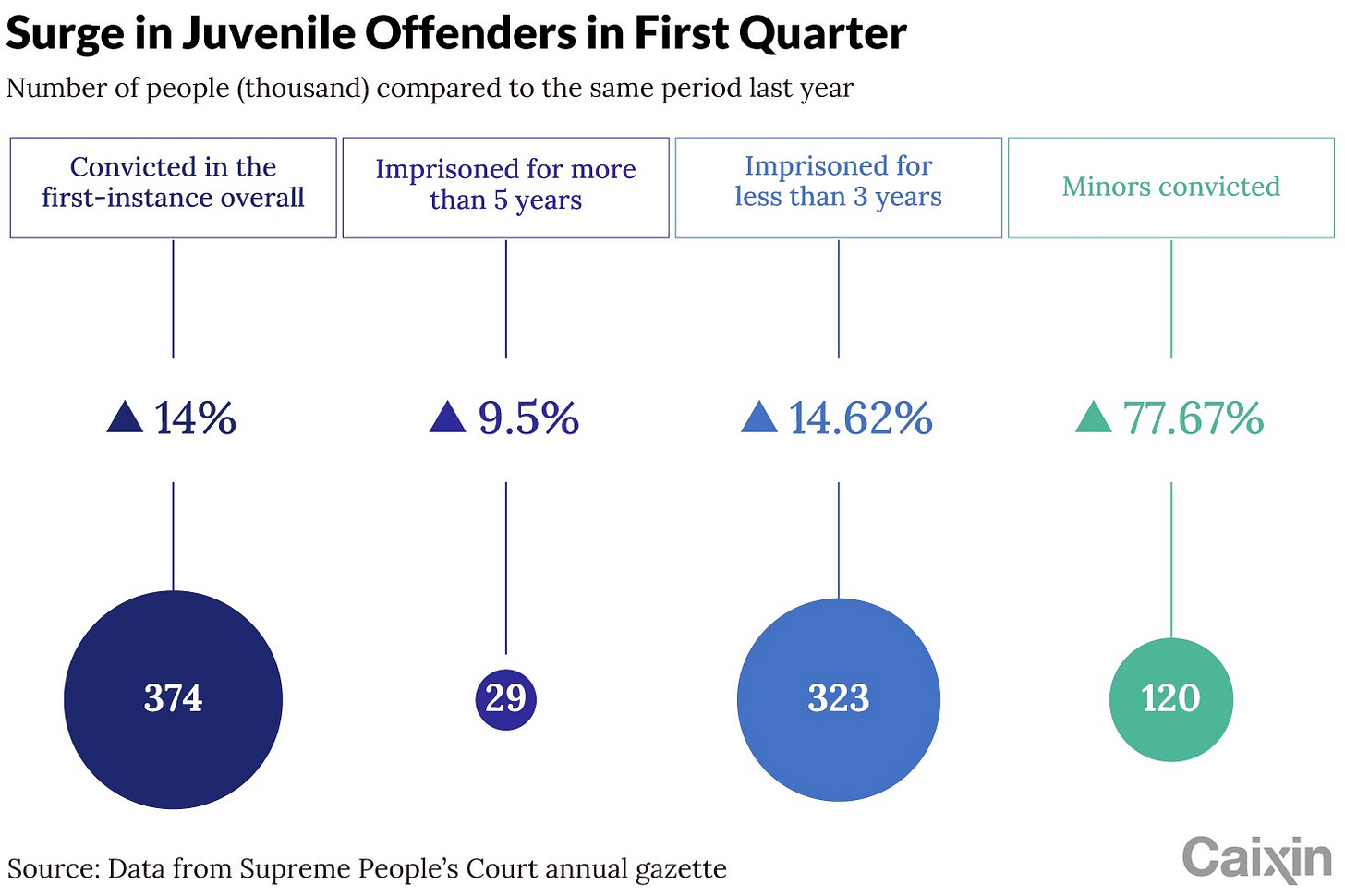

Law Enforcement

Criminal convictions are on the rise, especially for minors (+77%), according to Caixin Global. There’s been a number of high-profile stories of violence by minors against minors and children this year. A heart wrenching trend.

Energy: Chinese Wind Power

China’s wind dominance.3

Chinese wind-turbine makers made up four of the world’s top five manufacturers last year, the first time they have achieved such dominance over the global industry, a new analysis showed.

The achievement came on the back of strong growth in their home market. China accounted for 65% of the world’s newly added wind power capacity in 2023, consultancy Wood Mackenzie said on Wednesday.

Subsidies led to massive growth of manufacturing but when they were removed in 2021 prices plunged driving profits down.