The Brief: Reopening(!), retail sales, China luxury market, airline passengers, real estate sentiment, luxury earnings highlights

Trying to make sense of things

“Many shall be restored that now are fallen and many shall fall that now are in honor.” — Horace

In the last TB, we said: "China's fiscal health going into 2023 is looking dire" and this is already playing out with reductions to elderly medical benefits.

2023 may be a year of divergence: some consumers recovering faster than others, some local government’s fiscal health deteriorating faster than others, some real estate markets recovering while others do not.

On the ground in Beijing, we’ve noticed traffic picking up significantly, crowded malls and restaurant wait times back up.

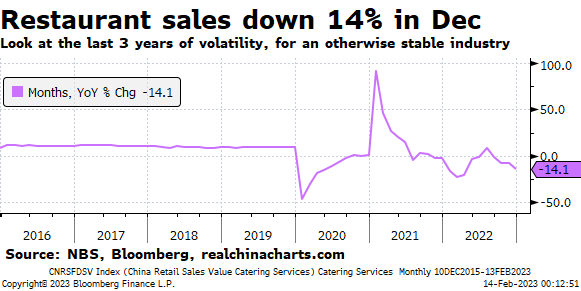

While many restaurants have closed in the last 3 years, the survivors may benefit from a surge of dining out in the next 3 to 6 months.

Still it will take time for full recovery:

Airline passengers significantly lags pre-Covid levels

Real estate sentiment remains low

Auto sales dropped in January (per CPCA data), though used car sales seem to be strong

Consumer goods companies remain cautiously optimistic in their commentary on China’s reopening

Traffic, unfortunately for us, seems to be the first to recover (chart from BNEF).

Contents

Luxury goods transcript highlights (premium content)

I. Retail Sales

December retail sales came in less negative than November.

Restaurants had an awful 3 years. This shows monthly yoy change. Restaurants are competitive, but the “pie” was steadily increasing—zero-Covid changed that.

Food, beverages and tobacco — Alcohol & tobacco won’t see the surge they saw in Q1 2021 because it was mainly due to recovery from extremely low levels in Q1 2020 during Covid’s emergence.

Clothing, cosmetics, jewelry — Lockdowns in Q2 and Q4 were bad for cosmetics and jewelry. Clothing ticked up in December.

Somewhat surprising: express mail package volumes increased in Q4. This may show the lighter version of zero-Covid restrictions in Q4 had less impact on e-commerce.

Not surprising: sales of medicine surged in December as Covid cases surged.

II. Bain’s China Luxury Report

Link to full report, excerpts and charts below.

China’s mid-to-high income consumers projected to outpace other emerging markets.

Chinese luxury market declined in 2022, disrupting a 5-year high growth trend.

Many consumers opted to stay home, even after movement restrictions relaxed. Luxury brand leaders told us shopping mall traffic was down 30%–35%.

Watches most affected. Since lockdowns limited offline store interactions, online penetration helped.

All luxury categories were affected by the decline, although not to the same degree (see Figure 2). Categories with strong online penetration were less affected by lockdowns and fared better. For example, with 50% online penetration, luxury beauty only contracted 6%.

VICs (Very Important Clients) were ~2% of customers but ~40% of market value.

VICs in China became more concentrated (higher percent of market value and or lower percent of total customers).

Entry-level luxury consumers spent less in 2022, i.e. they felt more pain from the weak economy.

This highlights a nuance in the weak consumption story: VICs (high-spending luxury shoppers) were less impacted by zero-covid and weak economy. Non-VICs reducing their spending could signal weaker economic condition for lower wealth/income segment.

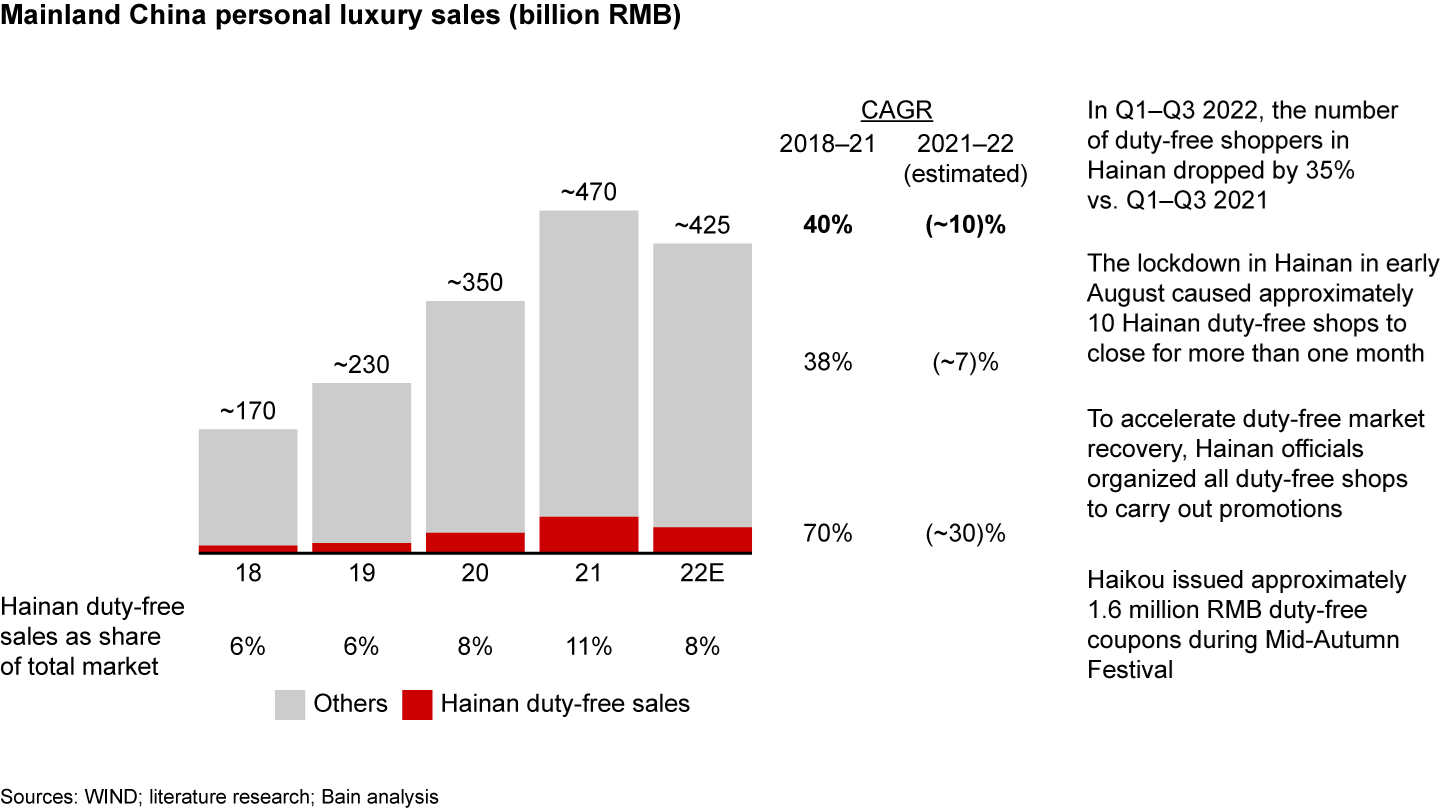

Domestic travel restrictions impacted Hainan’s duty-free sales

Duty-free sales could be down 30%, landing around RMB 35B in 2022 (see Figure 4). That was far below the Hainan Development and Reform Commission’s target of RMB 100B. The decline was slightly offset by an 8% increase in spending per shopper.

—NOT INVESTMENT ADVICE.— China Tourism Group Duty Free Corp (1880 H-shares & 601888 A-shares) had >96% of revenues from tax-free products, which declined to 63% in 2021 as they added taxable products. It’s H-share offering lockup is ending this month (02/24). They were a covid beneficiary as China closed its borders and domestic duty-free sales initially surged. They opened a new mall in Haikou Hainan on Oct 28, 2022. Consensus estimates have their revenue growing ~70% in 2023. CTG Duty Free’s market cap is 150% above pre-Covid levels.

Luxury goods prices are lower outside of China, giving more price sensitive shoppers a reason to travel internationally.

III. Airline Passengers

Domestic lagged 2019 levels by around 30 million passengers

International lagging by around 6 million passengers

Don't expect a fast rebound in these figures as flight capacity has been severely reduced during the last 3 years, airlines need to lease planes and hire pilots and staff in order to add capacity

IV. Real Estate

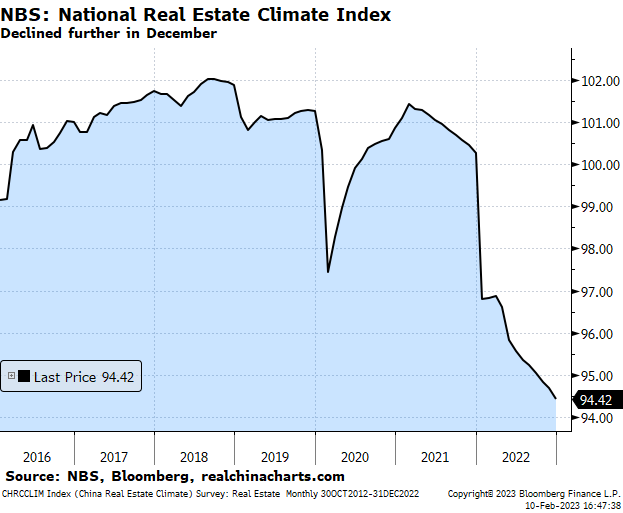

China’s stats bureau’s real estate climate index fell to its lowest level in December. We don’t think real estate can be the wealth generator it was in the past.

China’s urban property markets have very low rental yields. Part of the problem is the stigma around renting for families. A possible remedy is some renter protections—renters can be kicked out in very short notice with only 1 month rent penalty to the owner—but we digress.

Centaline manager survey moved upward in January 2023.

Developer land purchases were down in 2022. SOE developers declined less than privates.