THE BRIEF: LGFVs "Tapped Out", 2023 births look to drop, Subway traffic signals, US-China relations, Service announcement

Trying to make sense of things

We’ll jump right in.

Contents

I. LGFVs “Tapped Out”

Rhodium Group published a great analysis on the state of LGFVs deteriorating financial strength. Excerpts, charts and our takeaways follow. LGFVs are Local Government Financing Vehicles. Wikipedia does a good job describing them. Basically, they are a “way” (originally a loophole) for local governments to access a municipal bond-like market. We’ve previously written about them here (free) and here.

Key takeaways:

Weakness in Local Govt finances prevents Beijing from utilizing fiscal policy to support the economy, this is why there has been no meaningful support so far.

Expect more public calls for help by local governments.

Why we think watching China's economy and political economy will be fascinating over the next 5 years:

"The critical question after a probable large-scale local debt restructuring is what role local investment will continue to play in the future of China’s economy."

"Restructuring local debt or “solving” the local government debt problem would change China’s entire economy."

"LGFV's alone hold over 59 trillion yuan in interest-paying debt and payables, around 50% of GDP"

"At this point, China cannot allow local government investment to collapse, but similarly cannot finance this investment using current methods."

"Even investors who believe in Beijing’s financial commitment to LGFVs do not expect those implicit guarantees to last forever, because of the size of the debt burden."

We highly recommend reading the piece. It’s full of great charts, some of which follow with excerpts. They paint a pretty bad picture.

LGFV short-term debt increased sharply in 2022

Against a slower growth of debt, one concerning development is the rise in the proportion of short-term debt, which reached 25.7% last year, the sharpest increase since at least 2018 (Figure 2).

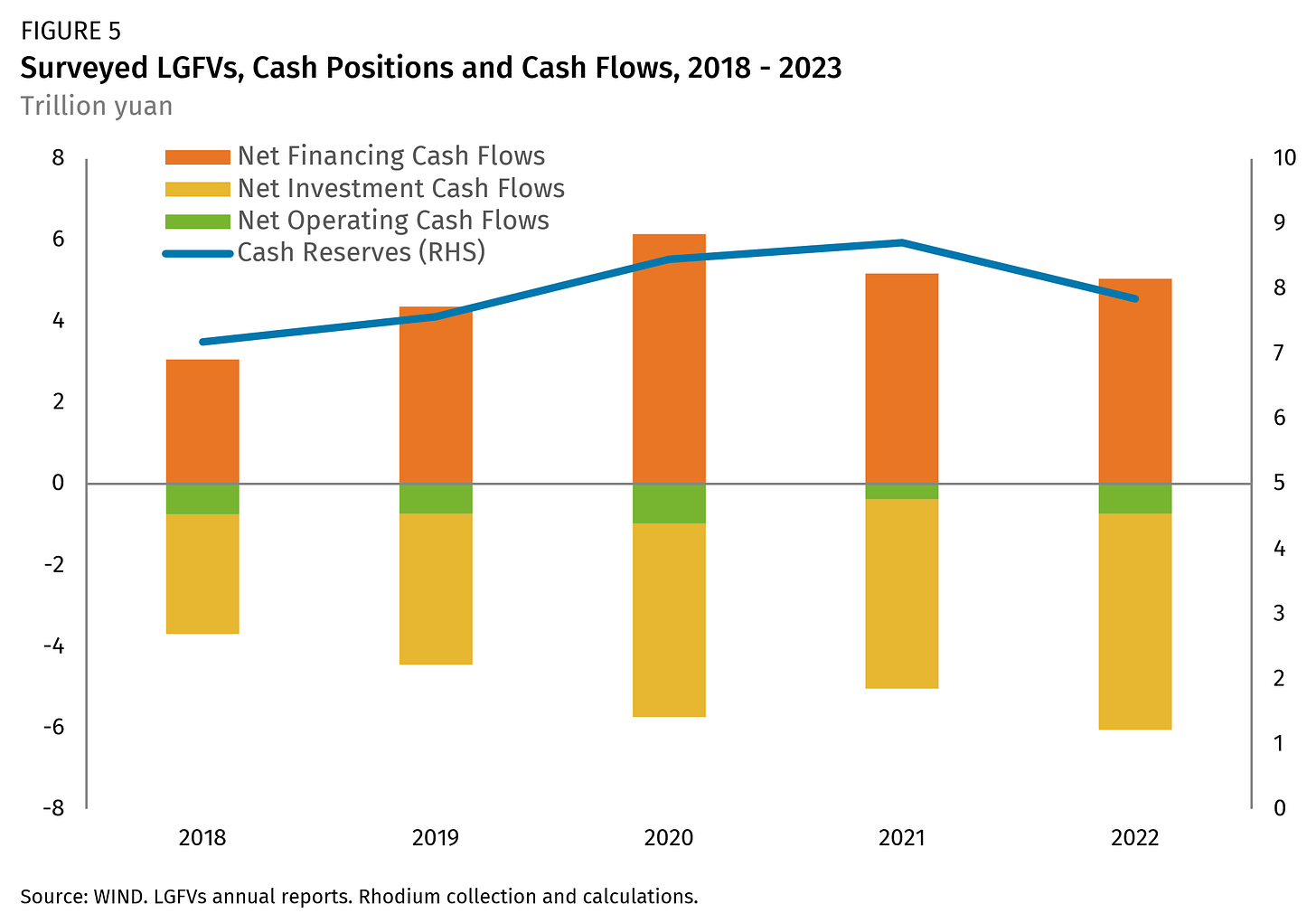

LGFVs cash position is deteriorating

The most significant development in LGFV finances in 2022 was a decline in overall cash positions, from 8.7 trillion yuan at the end of 2021 to 7.8 trillion yuan, primarily due to net cash outflows of nearly 1 trillion yuan among surveyed firms (Figure 5).

Investment cash outflows drove the decrease in cash, as "LGFV's were tasked with supporting growth in the second half of 2022."

Weakest link to determine interest rate policy

After discussing LGFV's low return-on-assets and Yi Gang's golden rule on appropriate interest rate levels:

This is a key reason why we anticipate Chinese interest rates must gradually decline over the long term, in order to make local debt burdens sustainable. Monetary policy will need to be set based on the weakest elements of China’s financial system, particularly localities and their LGFVs, rather than the stronger sectors of the economy.

Follow-on effects will be a weaker CNY (vs USD).

A rolling loan gathers no loss

Only 1/5th of Rhodium's surveyed sample have cash to cover short-term obligations. And nearly 4/5 do not have sufficient cash flows to cover interest payments, i.e. interest will be capitalized, resulting in ever larger debt balances.

LGFVs bolstered land sales at end of 2022

Restructuring local government debt increasingly urgent

We already know that consumption driven growth is going to be very difficult to attain because of demographics, see Data Leak, Demographics and Consumption. They are left with fiscal policy, productivity/technology (perhaps AI?), exports and “data(?)”.

For China to again be able to rely upon fiscal policy to deliver growth, Beijing urgently needs to restructure local government debt. LGFVs’ financial results in 2022 highlight that no solution will emerge from localities themselves. Beijing would like to take its time with a deliberative process over the summer, but rising calls for help among localities may eliminate that luxury as more urgent actions to stabilize local finances are required.

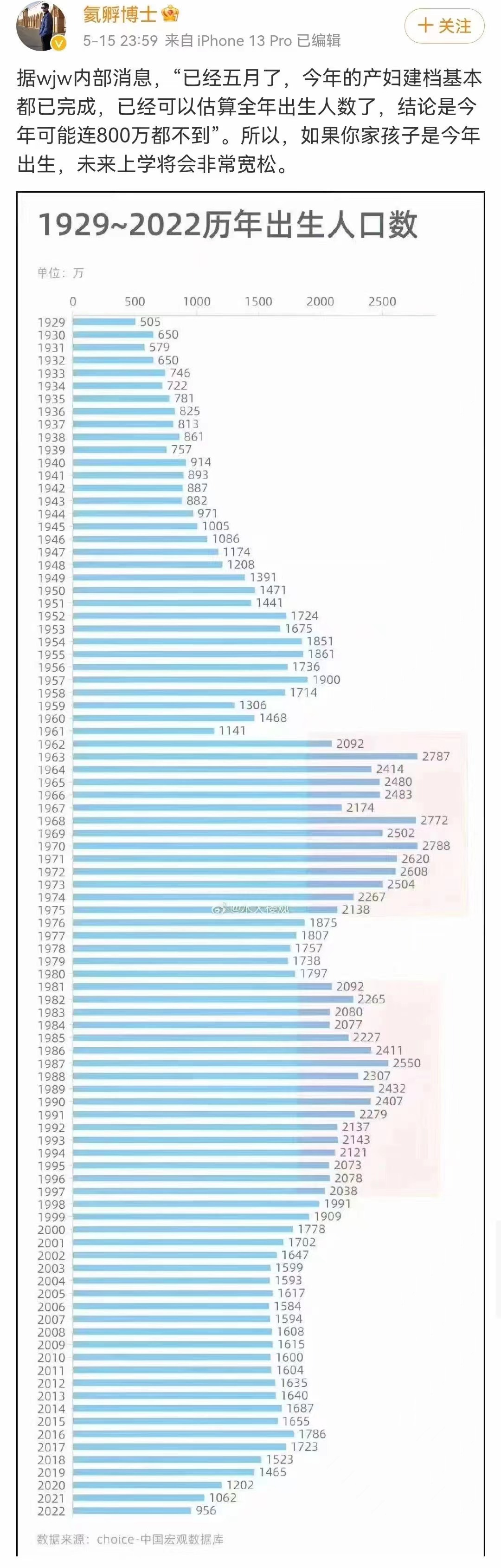

II. Demographics: estimated 2023 births won’t reach 8 million

Down from 9.5 million in 2022. This screenshot is from Weibo, rough translation:

According to wjw internal news, "it is already May, this year's maternal filing has basically been completed, has been able to estimate the number of births for the year, the conclusion is that this year may not even reach 8 million." So, if your child is born this year, their future school will be less competitive (very relaxed).

We love the positivity: Gaokao (college entrance exam) for kids born this year will be less competitive.

III. Subway traffic, maybe not what it seems

High subway traffic but decline in economic activity index? Less surprising if you've been questioning the robustness of the reopening narrative, as we have. Subway rides are much cheaper than buying gas, driving or ride-hailing. Extremely high subway ridership not an indication of desire to spend.

IV. Signpost: US-China Relations

A small, but warmer, measured & friendly, breeze is blowing in the US towards China. There are some examples, here is another. Will the new winds catch a sail? (Let us know what you think!)

NY Times opinion piece by former counselor to US Treasury Secretary in Obama administration who’s firm oversees significant investments in China

More than in the past, Chinese investors and entrepreneurs are carefully noting — and following — every signal from the government and worrying that Mr. Xi might suddenly announce another capricious and unexpected intervention into the private sector. Starting consumer internet platforms has been de-emphasized; investment in new industries such as energy transition and artificial intelligence appears to be the priority.

China has proved it can continue to grow faster than we do. We need to outcompete the country by raising our growth rate through initiatives like addressing our imprudently large budget deficit and our stultifying rules on the building of industrial facilities.

And we should buttress our human capital by increasing STEM graduates so that we can maintain our technological edge and by restructuring our immigration policies to attract talented people from all over the world and keep our most promising foreign students here.

V. Service Announcement

As LONG VIEW has done, THE BRIEF is also transitioning to premium-only content. We will still occasionally post free content. So subscribe to the free tier if you are unsure. Until now, our content was free to view on a rolling basis and subscribers would have access to the archive in their email from the day they subscribed. Many thanks to our paying subscribers who have supported us thus far! It’s very motivating to see you value our work.

If you are still undecided, you can signup for a free 7-day trial to view our archive.

We are a pair of finance professionals with extensive experience in China. We love putting out China Charts and are pleased that it goes out to over two thousand brilliant readers worldwide. Please join us on our journey to better understand China through charts and data by subscribing or help us spread the word.