Retail sales ceiling?, CPI commodity components and Chart roundup

Trying to make sense of things

*This is a premium-only post. Thanks for being a subscriber, it means a lot.

Key Message:

Retail sales remain quite weak, the post-opening recovery yet to be seen in “consumable goods”. Where we see it is in travel and services. Property market remains subdued, despite the consistent drip of policy loosening. Perhaps if loosening occurred all-at-once, we’d see confidence and activity return?

"In many areas of policy and business there is much more value to be found in understanding how people behave in reality than how they should behave in theory." — Rory Sutherland, Alchemy

Contents

Retail sales ceiling?

Charts roundup

I. Retail Sales ceiling?

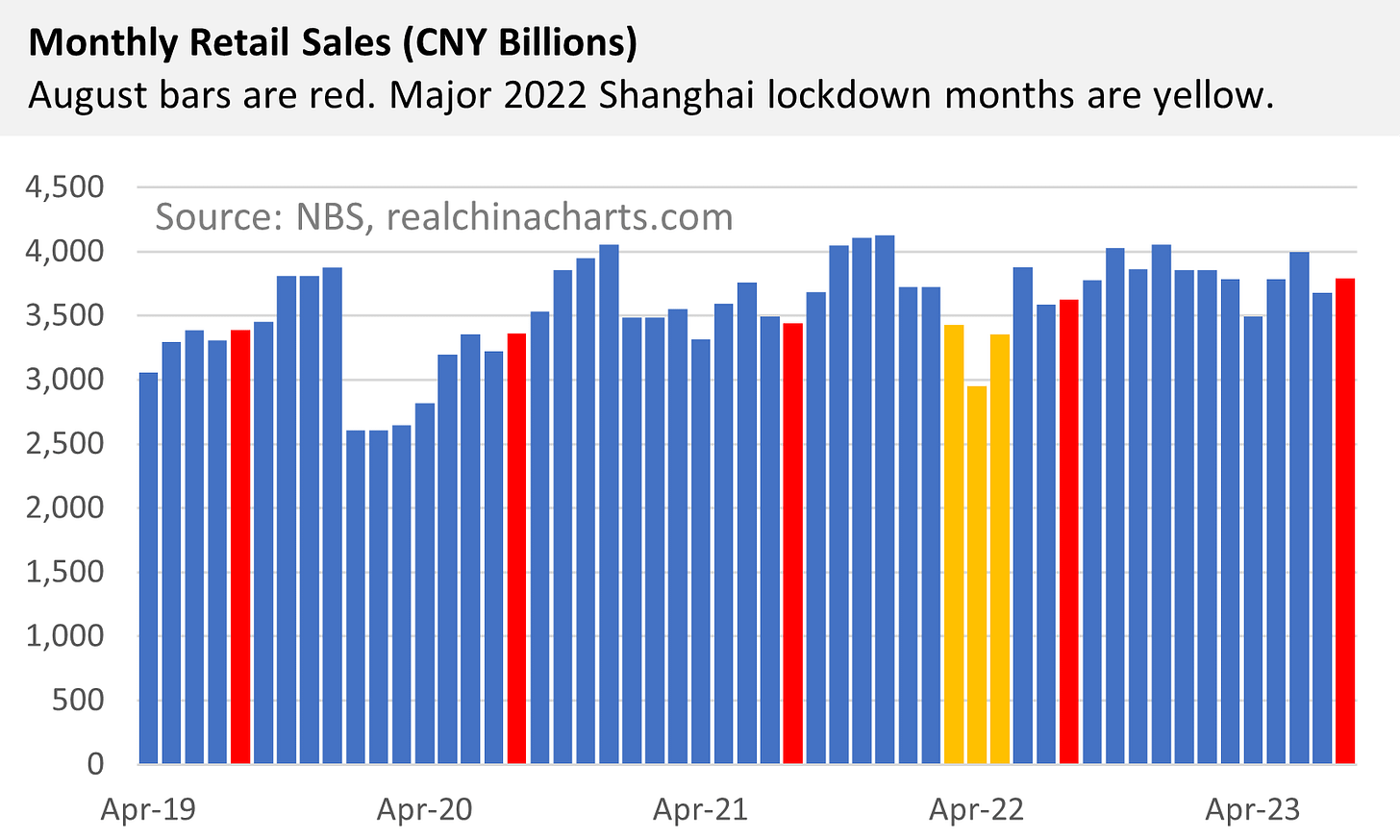

Monthly retail sales values remains between CNY 3.5 and 4.0 Trillion.

Is CNY 4 Trillion a ceiling or should we expect to pass it later in the year? In 2019, 2020 and 2021, the last three months of the year saw a big jump. Perhaps we’ll see that again this year. Certainly, China’s policymakers are hoping we do.

The re-opening “boost” was mainly base effects. See 2023 Mar-Apr-May is an inverse of 2022 for those months.

Turning to the categories for firms above a designated size…