Real estate inventories, absorption remain high; Viktor Shvets podcast appearance and our thoughts

Charts this week 11

*This is a premium members post. A free preview of about 50% is provided. Thank you for your support!

"The difficulty lies, not in the new ideas, but in escaping from the old ones." - John Maynard Keynes

Real Estate

Real estate is an illiquid asset. The market remains frozen. This has immediate flow through to consumption and consumer sentiment. As long as capital is stuck in real estate and can’t find liquidity, we expect consumption to remain low.

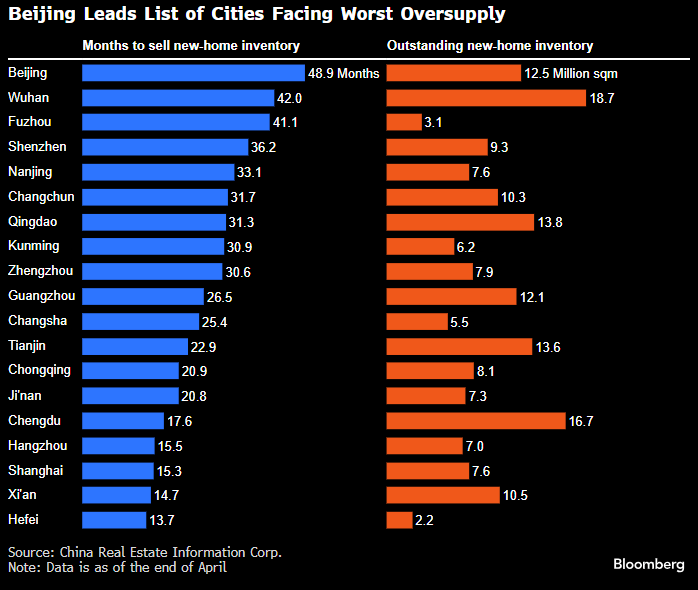

The amounts of inventory needed to work through is mind-blowing. We’re hearing in Beijing people taking their apartments off the market, preparing to list them again soon possibly at lower prices. The below chart is only new-home inventory.

Including used homes, Beijing remains #1 for longest to sell inventory for Tier 1 cities.

We previously posted about Shenzhen’s jump in absorption period and joked at the end of the piece that the data would get fixed. It did. Read that piece here.

Viktor Shvets on Odd Lots

Viktor is unlike most economists out there today because he has studied “both sides” (if we may). He was born in Soviet Ukraine where he went through the Soviet education system and eventually attended Kiev University of Trade. He later emigrated to Australia, where he completed a Bachelor of Economics degree from the University of Sydney and a Master of Commerce degree from the University of New South Wales.1 This broad range of views often comes through in his writing and commentary. We are fans.2

Here we share some quotes from Viktor on his recent Odd Lots appearance. Our comments will be preceded by “RCC >” and in italics.

On China’s high savings rate leading to overcapacities and exporting disinflation:

Well, one of the things I disagreed with almost everyone over the last two or three years, remember the view was that China is running out of people and so China will be exporting inflation. Now, my argument all along was China cannot export inflation, they’re a major export of disinflation.

And the reason for that is very simple. China, just like Japan's seventies, eighties, has a very high national saving rate. They're running at about 45%, Just like Japan in seventies, eighties could have put policies in place to consume it, but they didn't. Neither have China.

And so the result is they must invest at least 42%, 43% of GDP. Think of the numbers, that's an equivalent of $9 to $10 trillion invested every year. It's double of GDP of Japan invested every single year. Now, if you invest in that sort of money, it doesn't really matter what you invest in.

You create massive overcapacities. And if you go into niches, things like what Xi Jinping calls “productive forces,” things like electric vehicles, robotics, automation, solar industry, if you go into smaller niches, you almost automatically create three times global demand, if not more.

On China’s options:

They have very limited choices. Either they pivot their policies dramatically, send checks to people instead of building another factory…

Tracy (15:39):

Build a social safety net…

Viktor (15:41):

Yeah, raise universal basic income. They already have universal basic income in China, just raise it and equalize it across the country. So you either do that, but if you're not willing to do that, which they're not, then the only way you can do it is accept that you lost the capital and close the factories.

RCC > Either (1) they stop building that next factory and instead send the money to households or (2) they accept the loss of capital (“fixed capital investment” i.e. the money invested in factories and equipment) and close the factories.

We’d like to clarify, China doesn’t have universal basic income. What China has is subsistence allowances, from which about 44 million people received about $100 a month in Q1 2021.3 These could be increased and equalized.

Back to Viktor:

And we will discover China potentially is a much smaller country than what we thought it was, or the other alternative dump that excess capacity onto other countries. But given the amounts of money involved, there is not much you can dump on Kazakhstan. So there is only UK, European Monetary Union or EU, United States, Japan. There's very few places that can take that sort of capacity.

And so what's happening, those countries are putting up barriers. Now, the reason they're putting up barriers is that China also wants to change the world. They want to redesign everything, whether it's human rights, information, whether it's the role of state versus individual, whether it's [the] role of state subsidies, trade rules, they want to change everything.

So if China did not try to change world, I think the extent to which the barriers would've come up would not have been as aggressive. But now China has a Catch 22. Barriers will come up, which means it's harder to sell that excess capacity. You don't want to recognize the loss of the capital.

RCC > We think this point about China trying to change the world is important. The fact is US, UK, EU, Japan, etc. have been consumers of Chinese exports for a long time now. If China wants to change the status quo that those countries seemingly hold dear, why should they continue to allow open access for Chinese goods?