China Charts #11 China’s Households Are Still Playing Defense

A look at PBOC surveys: Green shoots are visible, but structural pessimism still dominates.

It’s been a while since I’ve taken a close look at China’s economic indicators. Many are now being released with long delays—some not at all. The PBOC’s urban depositor survey is no exception. Starting in 2023, the Q3 results, which used to be published in early October, have been withheld until March or April of the following year, bundled with Q4. That delay severely limits the usefulness of the data—perhaps by design.

For today’s piece, we dig into the newly released Q3 and Q4 2024 results. Let’s dive in.

Thank you for subscribing. Occasional forwarding is okay. If you are not a member, please sign up here.

“Stubbornly persist, and you will find that the limits of your stubbornness go well beyond the stubbornness of your limits.”― Robert Brault

Key takeaway: Green shoots are visible, but structural pessimism still dominates.

PBOC Depositor Sentiment: A Mixed and Cautious Mood

Urban depositor surveys from the People's Bank of China (PBOC) reveal a population that remains cautious, risk-averse, and deeply influenced by long-term structural headwinds. Sentiment has weakened across income, employment, and housing—while spending preferences show subtle shifts.

1. Structural Weakness in Income and Employment Confidence

Both Income Sentiment and Confidence have been in a downtrend since 2018—the year US-China trade tensions escalated. The decline accelerated around COVID and deepened with domestic lockdowns. The same deterioration is visible in Employment Sentiment and Expectations, which now sit at series lows.

Downtrend in income sentiment started around the trade war kickoff.

Employment expectations have steadily worsened over the last 5 years.

Together, these reflect diminished confidence in personal economic prospects.

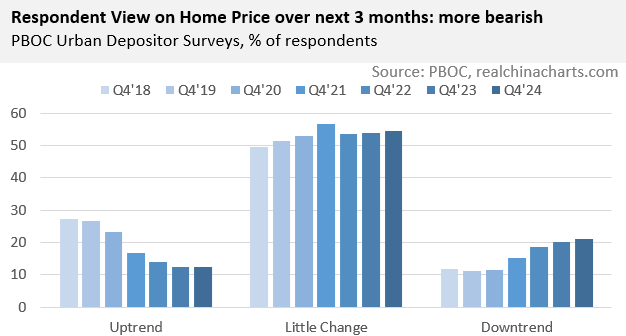

2. Deep Pessimism in Housing Market Outlook

The housing market—a key pillar of China’s economy—continues to show signs of stress:

Home price sentiment has been bearish for 6 consecutive quarters, unprecedented in this dataset.

Home sales peaked in mid-2021, and both volumes and YoY growth remain well below historical norms, although there are signs of stabilization in recent months.

The number of people expecting an uptrend in prices has risen slightly in Q4’24, hinting at a potential inflection point.