Charts This Week #7

Charts and links about China

*This is a premium members post. Thank you for your support!

ENERGY: China leads in new coal power

China accounted for 2/3’s of the increase in coal power. Energy security is alive and well.

While officials say the plants will primarily be used to balance out intermittent generation from rapidly growing wind and solar farms, the building boom has raised questions about China’s climate commitments and stymied global efforts to phase out use of the dirtiest fossil fuel. (Bloomberg)

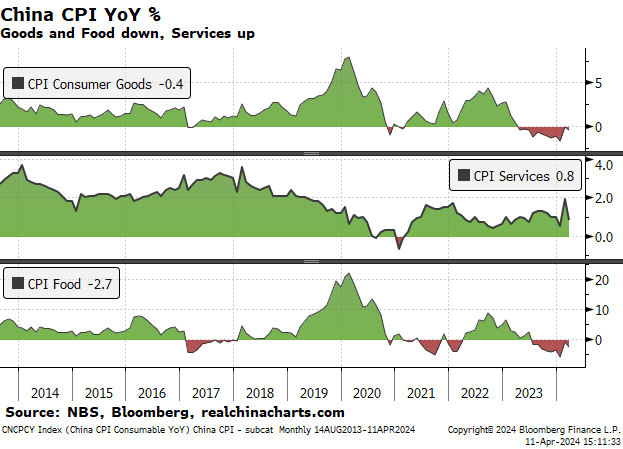

PRICES: China CPI YoY +0.1%

And the subcategories. Consumer goods and food in deflationary territory. Food down the most -2.7%.

In Food, biggest declines were eggs (-8.9%), fresh fruit (-8.5%), beef (-8.4%), mutton (-6.0%), oils and fats (-5.3%). Pork was only down -2.4% in the index.

In consumer goods, biggest declines were in communication equip (-2.4%), durable goods (-0.8%)—possibly further sign of weak consumer.

What companies are saying about China’s consumer…

Next, we take at look at what companies are saying about the Chinese Consumer on earnings calls, dates of comments in parentheses.

Other Asian countries outside China growing double-digit…

Barry Callebaut (2024-04-10) - a Swiss cocoa and chocolate manufacturer

Last but not least, and that's certainly hold back by the China consumer sentiment situation, in all countries outside of China and Indonesia in Asia, we're actually growing close to double-digit, which is good progress from the team there.

Must say that it’s challenging, but think that it’s positive…

Ermenegildo Zegna (2024-04-05) - an Italian luxury apparel company

First of all, we have been traveling quite a bit with Leo and Rodrigo in the past few months, so I think we have a good grasp of the Chinese market overall. And I must say that it's challenging, but I think that it's positive. And it's a -- surely, we see less traffic than we used to see, so I think that you have to work more less transactionally, more relationship driven with the customer.

EZ separates their Chinese clients by aspirational and very committed, basically upper-middle class and upper class. The upper-middle is not doing well. We have a theory (others have it too) much of the prior upper-middle consumption was driven by wealth gains in Real Estate, rather than higher incomes.