Chart Roundup: LGFVs-our view, PMIs, Employment, Foreign capital outflows, Fund flows, Chip equipment, Insurance, Indirect taxes

Roundup of interesting charts about China

Contents:

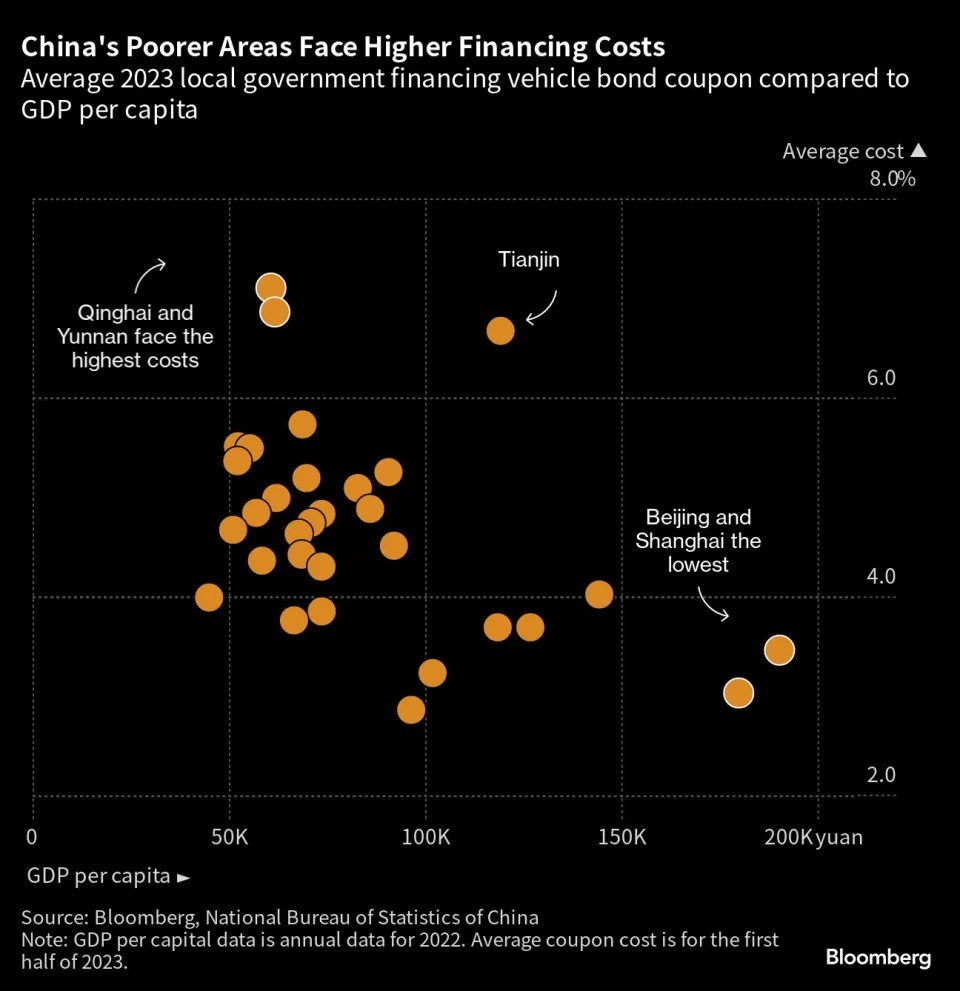

I. Our view: LGFV issues to get worse

In this section we share our view (in bold) on charts/quotes from an interesting recent article. This week’s (victim?) is a fantastic write up by Bloomberg: China’s LGFV Insiders say $9 Trillion Debt Problem is Worsening

[Beijing] set in motion a plan before the pandemic to inject state-owned assets into the companies and permit them to enter new business areas to generate enough cash to service debt on their own. This was known as the “market-oriented transformation” model.

“We are indeed talking about transformation,” said an employee who works at the company in Chongqing. “But to be honest, so far we have not found out any good path to transformation yet.”

The ones with too much debt seek to fix it by making their business more complex, entering new businesses—this is incredibly difficult to pull off.

The companies rely on local governments for income, in the form of payments for infrastructure and pure subsidies. They also borrow from banks and by selling bonds, which are generally seen as carrying an implicit government guarantee of repayment.

“SUBSIDIES.” A key word in the creation of these debt problems. Allow us to go on a little rant.

LGFVs & local governments were discounting services, land, personal income taxes, business taxes, fees, and (yes!) infrastructure to the end user.