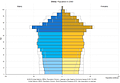

THE BRIEF: China's Demographics, is Covid an accelerant or temporary disruption?

Population growth slows, UN Demographic charts, Covid impact on births, Singles Economy, Retail sales, CPI PPI, CNY in Swift, Billionaire Cities

This is THE BRIEF, one of two of our weekly columns. We are a pair of finance professionals with boots on the ground in China, each with 10 years of experience in the country. This is The Brief, a collection of charts on China’s economy and what we find interesting.

If you don’t subscribe yet, click the button below 👇